Our startups win big at the Philips Innovation Awards!

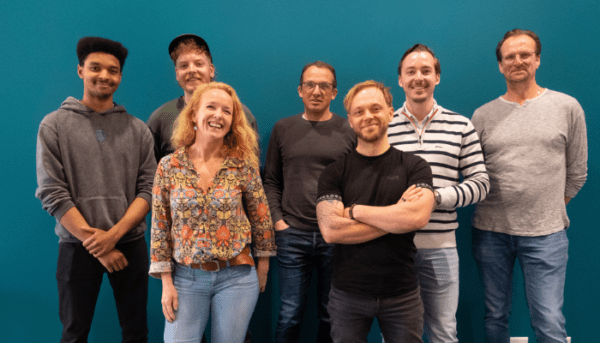

Eight exceptional student-led startups battled it out live for the Netherlands' top student entrepreneurship honor: the prestigious Philips Innovation Award. Two groundbreaking ideas from our foundership startups ultimately claimed the top prizes.